The Sag Harbor School Board voted on April 19 to adopt a $48.06 million budget plan for the 2023-24 school year, though the plan — with a tax-cap-compliant 1.88-percent increase built in — is not expected to be the hottest item on the May 16 ballot.

Instead, it’s Proposition 2, proposing the purchase of five lots on Marsden Street for a total of $9.425 million, that has become a controversial topic. Voters will be asked to vote on borrowing a $6 million bond and releasing $3.425 million from a facilities capital reserve account, which collectively would fund the land buy.

The possibility of a new sports field has dominated the Marsden Street conversation since the first potential deal, which involved money from Southampton Town’s community preservation fund, was unveiled in September 2022. More recently, school officials pulled out of the deal with the town and stated that it would decide the exact use of the land later, should residents approve money for the purchase. The five lots are the property of a private owner who has indicated that they will be developed into houses if the school deal falls through. Last night, the school board and administration held a forum to address the Marsden Street plan.

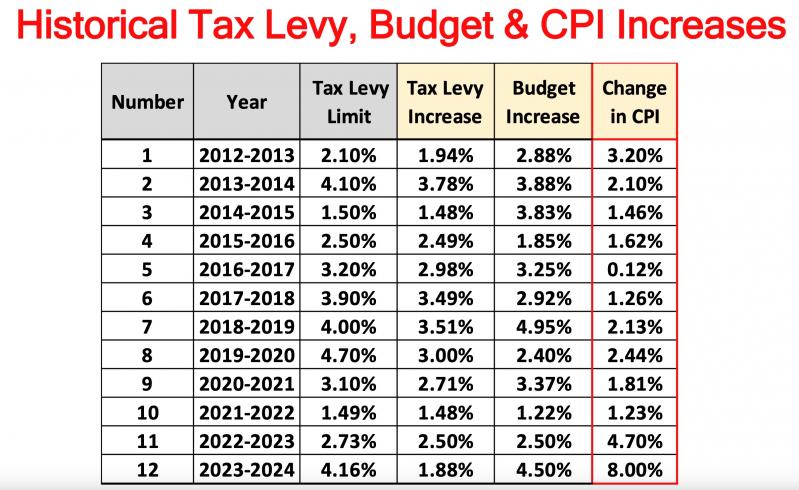

Back to the budget: Sag Harbor’s 1.88-percent increase is among the lowest proposed tax-levy hikes on the East End, and is less than half of what the state would have otherwise allowed for Sag Harbor. School officials say the budget preserves all programs, activities, services, and infrastructure needs. For a house with a market value of $1 million, school taxes would rise by about $67 for the school year.

Sag Harbor is also seeking voter approval to create a new type of reserve account dedicated to technology and security. It would not affect school taxes. A “yes” vote to Proposition 3 would allow the district to save year-end surplus money, up to $10 million over 10 years, for future upgrades and new equipment.

The district is also working, for the first time, with the Sag Harbor Historical Museum on a proposition to approve collecting a total of $75,000 in tax money to support the museum’s operations and programs. If approved, Proposition 4 would increase taxes by $6.48 for the year.

A public hearing is planned for Monday at 6:30 p.m. in the Pierson library. Voting is from 7 a.m. to 9 p.m. on May 16.