A seemingly routine aspect of public-school finance is tripping up local school districts that find themselves having to borrow money during the months before tax revenue starts to flow in.

Schools borrow what’s known as a “tax anticipation note,” or TAN, to pay for operating costs during the first few months of the school year. Like almost every other type of loan, TANs cost districts — and therefore the taxpayers — money on interest. And that’s a big deal in the current economic climate: In a Jan. 12 announcement, New York State Comptroller Tom DiNapoli said inflation stands at about 8 percent for those entities, like schools, with a fiscal year ending June 30, 2024. This time last year, Mr. DiNapoli’s charts show, that was 4.7 percent, and 1.3 percent the year before that.

“The interest rates have gone through the roof and are continuing to increase,” Jennifer Buscemi, business administrator for the Sag Harbor School District, told the Sag school board on Monday.

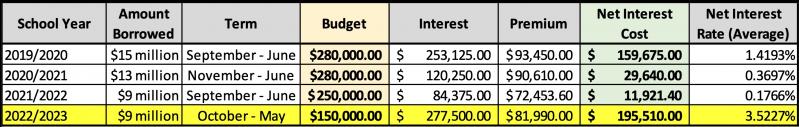

This year, Sag Harbor is looking at spending more than $195,500 on interest on the $9 million tax anticipation note that it borrowed to pay for teacher salaries, classroom supplies, utilities, and just about every other type of budget line from October through May. By way of comparison, a far more favorable interest rate on the same amount meant TAN interest cost Sag Harbor $11,921 last year.

In the East Hampton School District, Sam Schneider, assistant superintendent for business, addressed the same dilemma during a Jan. 17 school board meeting. One cause, he said, is that schools run on a fiscal year from July 1 through June 30, whereas town governments, which receive property tax payments, follow calendar years.

That means for about half the school year, “we have no money coming in, but we still have money going out,” Mr. Schneider said. “People want to be paid, vendors want to be paid, health insurance wants to be paid.” TANs “bridge the gap” during those months.

East Hampton and Sag Harbor share a common benefit: They both have excellent credit ratings with Moody’s Investors Service, which means they can borrow large sums of money at more favorable rates than school districts with lower ratings. East Hampton’s rating is Aaa, the best category, and Sag Harbor’s is Aa1, just one little notch below the top.

“There are very few school districts that have that,” Mr. Schneider told the East Hampton School Board last week.

“Our credit rating saved us” close to $100,000 on interest, Ms. Buscemi told the Sag Harbor board on Monday. Sag Harbor’s current TAN has a 3.52-percent interest rate; last year’s rate was approximately .18 percent. “Some districts have to pay just under 4 or 5 percent for the same amount of money,” she said.

Mr. Schneider told the East Hampton School Board that the district saved money this year by splitting its $16 million TAN into two pieces, paying a total of about $409,000 in interest with a rate of 2.73 percent. Last year, the rate was 1.5 percent, the TAN was for $15 million, and the district paid $161,250 in interest.

East Hampton and Sag Harbor are also facing sharply rising health insurance costs, particularly for the family plans for active employees.

Most, if not all, public school districts take part in the New York State Health Insurance Plan for public entities, called NYSHIP for short. A family plan through NYSHIP costs more than $38,000 this year, with part of that paid by the districts’ employees. According to Mr. Schneider, over the last 24 years, the price of family health coverage has risen nearly 500 percent. Unless health insurance costs start to go down, he said, in another 24 years, a family plan will cost around $190,000.

Beyond the sheer cost, health insurance presents another challenge — the rates are set in December for the following year, meaning that the fiscal-year issue comes into play again and budgets are based on conservative but educated estimates. “I know exactly what it’s going to cost us from July until December. The question mark is what it’s going to cost us from January to the following June,” Mr. Schneider said.

In her presentation Monday, Ms. Buscemi projected that total health insurance costs will rise for Sag Harbor by $765,724 next year, up to $6.5 million. The district is budgeting $12.58 million for all categories of employee benefits, which also include Social Security payments, disability insurance, workers compensation, and compensated absences, among others.

In his presentation last week, Mr. Schneider said East Hampton is budgeting $12.22 million for health insurance, an increase of about $1.7 million.

Most districts are grappling with issues like these as budget season gets underway. School boards must formalize their 2023-24 spending plans by mid-April for a May 16 vote. Leading up to that, East Hampton has budget workshops planned during most of its regular meetings coming up, including on Feb. 7, March 7, March 21, and April 4. Sag Harbor’s budget workshops will take place on Feb. 6, March 6, March 20, and April 3.